GIM Blueprint

“A 3‑year contracted income structure designed to give Australians clarity, predictability, and ethical participation — without lending or performance dependency.”

The GIM is a 3‑year contract-based income structure.

Clear payments, no performance dependency, no lending required.

A pathway designed for Australians who want simplicity, transparency, and control.

Contract‑Led Clarity

Every pathway begins with a clear, plain‑English Contracted Lease Agreement — giving members certainty, transparency, and predictable structure without market noise or performance dependency.

Purpose‑Built Simplicity

GIM removes complexity and replaces it with simple, structured steps designed for everyday Australians to understand, compare, and make informed decisions with confidence.

Ethical Operational Management

AWA manages placement, compliance, tenancy, and day‑to‑day operations — enabling members to benefit from a contract‑based income structure without operational responsibility.

Future‑Ready Options at Every Term

At the end of each 3‑year term, members can renew, transition to a new product, buy back, release, or take possession for self‑use or self‑management, ensuring long‑term flexibility and control.

The GIM Formula: A 3‑Year Contract‑Based Income Structure

Clarity first. Contracts first. Education first.GIM (Göransson Income Multiplier) explains how Australians can participate in structured income pathways through a contracted commercial lease—without dependence on tenancy performance or market volatility. It’s a model to understand, not a forecast to believe.Primary CTA:Request the GIM Clarity PackSecondary CTA:Book a Discovery Call

What You Sign

- Contracted Lease Agreement

- Placement/Installation agreement (if applicable)

- Product delivery/ownership documents (for product purchasers)

1) What GIM Is —

GIM is a contract‑based structure created to give everyday Australians access to the kind of predictable, professional, and transparent income pathway usually reserved for private clients.You receive contracted payments defined in your commercial agreements. AWA manages the operational work behind the scenes.Truth‑first positioning:

- No financial advice. This page is education only.

- No performance promises. Payments are contracted, not contingent on occupancy or yields.

- Documents govern. Your signed agreements control amounts, timing, obligations, and options.

2) Why GIM Exists

Many Australians have the capacity to participate but are blocked by traditional hurdles (serviceability, complexity, or confusion). GIM replaces that noise with a simple, ethical, contract‑led pathway that prioritises clarity over features and pressure.

First Nations Leadership in Ethical Wealth Pathways

AWA is transitioning into majority Indigenous leadership with a mission to deliver ethical housing and income structures for Australians.

3) Who GIM Is For

- Homeowners with eligible unused space who prefer a commercial lease over new debt.

- Wealth‑Club members who purchase an approved product and prefer a contracted lease‑back structure for the first 3 years.

- Australians who value education and predictability over speculation.

Important: Agreement types are presented publicly as a single concept — a Contracted Lease Agreement that defines your payments and responsibilities. The specific contract(s) you sign will set out the exact details for your situation.

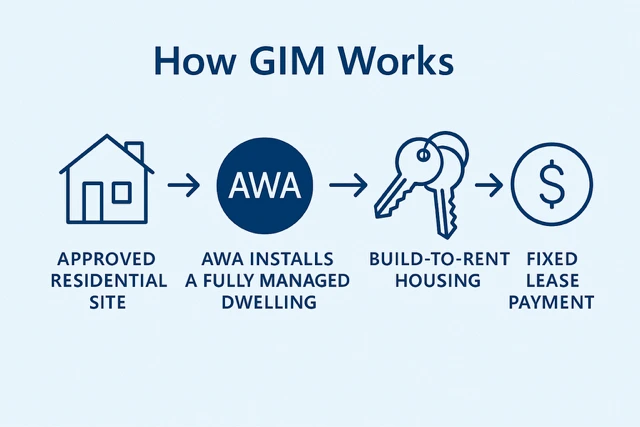

4) How GIM Works

- Education & Fit — You review the GIM Blueprint and, if useful, request the Clarity Pack.

- Eligibility — Address/product suitability checks for approved products.

- Contracts — You receive plain‑English summaries, then sign the Contracted Lease Agreement.

- Placement/Installation — An approved product is placed/installed and made tenancy‑ready.

- 3‑Year Term — You receive contracted payments for the 3‑year term (per your agreement).

- End‑of‑Term Options — You may renew, transition to a new product, buy back, release, or take possession for self‑use or self‑management, depending on the agreements in place.

GIM was created to give excluded Australians a fair, structured, and ethical way to participate — without borrowing or speculation.

5) The GIM Formula

GIM is intentionally simple on the client side:

Client Payment = Contracted Lease Amount × 3‑Year Term

Key principles:

- Payments are contracted, not performance‑based.

- The 3‑year term begins after placement/installation, as specified in your agreements.

- No management fees, maintenance reserves, or operational costs are deducted from your contracted payments.

- AWA carries the operational responsibility; you receive the contracted lease payments defined in your documents.

- Documents govern all amounts, responsibilities, and timelines.

Compliance Note: This page provides general information and education only. It is not financial advice, a recommendation, or a performance forecast. Always consider seeking independent, licensed advice (financial, legal, tax) before making any decision. Contracts and formal documentation control in every instance.

Look at our EXCLUSIVE Membership

6) One‑View Diagram

7) Roles & Responsibilities

You (Member/Client)

- Review educational materials and contracts.

- Sign the Contracted Lease Agreement.

- Receive contracted payments for the 3‑year term.

- Decide on end‑of‑term option(s) per your agreements.

AWA / Appointed Entity

- Provides the educational framework and access to approved products.

- Manages placement/installation, tenancy coordination, and compliance administration.

- Upholds standards, reporting, and member support.

Licensed/Qualified Partners

- Provide regulated services where required (financial advice, legal, tax, SMSF administration, property management).

- Operate under their own licensing and professional obligations.

GIM is NOT for:

- People looking for financial advice

- People wanting fast or speculative returns

- Anyone wanting investment performance predictions

8) FAQs

1) Is this financial advice? No. GIM is education only. We encourage you to seek independent, licensed advice before making any decision.

2) Are my payments linked to occupancy or rent levels? No. Your payments are contracted in the Contracted Lease Agreement. They are not dependent on tenancy performance or market conditions.

3) What is the standard term? GIM operates on a 3‑year contracted lease term commencing after placement/installation, as set out in your documents.

4) What happens at the end of 3 years? You may renew, transition to a new product, buy back, release, or take possession for self‑use or self‑management, depending on your agreements.

5) Do I need a bank loan? No loan is required for the contracted lease itself. If you choose external finance for personal reasons, that sits outside the GIM structure and requires independent advice.

6) Are there management or maintenance fees deducted from my payments? No. Management and maintenance provisions are not deducted from your contracted payments. The structure is designed so that your contract defines what you receive.

7) Who signs what? You will receive plain‑English summaries and then sign the Contracted Lease Agreement. Additional documents may apply depending on your circumstances and the product. The executed contracts control all amounts and obligations.

8) Is site or product eligibility guaranteed? No. Eligibility depends on assessments, compliance, and availability. We’ll outline requirements transparently before you proceed.

9) Can my professional advisers review the documents? Absolutely. We encourage you to share the Clarity Pack and contracts with your financial adviser, accountant, and solicitor.

10) How does this relate to AWA Wealth‑Club? Wealth‑Club members receive education, priority access, and updates. Membership fees are redeemable toward approved products per current policy (see terms). Your GIM participation is still governed solely by your contracts.

Check out our Build To Rent Stock

9) Tone, Language & Compliance

- Education‑led: We explain structures so you can choose with confidence.

- Plain English: Minimal jargon; clear definitions; direct statements.

- Contract‑first: All numbers and obligations live in your documents.

- Independent advice encouraged: Bring your adviser team into the process.

- Respectful & ethical: Indigenous‑led leadership and purpose remain core to AWA’s mission.

10) Final Summary

GIM is a clear, contract‑based income structure using approved products and professional management. You receive contracted lease payments for a 3‑year term, then choose your next step with clarity. No advice. No hype. Documents govern.